Advantages and disadvantages of a corporation diversifying internationally

Introduction

Diversification is the process of investing assets across a wide range of classes in differing proportions depending on an investor’s goals’, risk tolerance and time horizon. Although diversification does not guarantee the best performance or eradicate risks of investment losses, it helps in alleviating speculation usually involved in investing. Diversification may well be used to refer to the variation between businesses within a company. This variation may be by products and/ or services. Diversification meaning varies across businesses, as what stands as diversification in one organization may not have significance in another. Thus, the definition of diversification is subjective. Nonetheless, business diversification may be in the dimension of cost leadership, production of commodity products, new product development, market leadership, strong brand names, high value added products, niche markets served, customers shared, advertisement emphasis, customer service emphasis and product design.

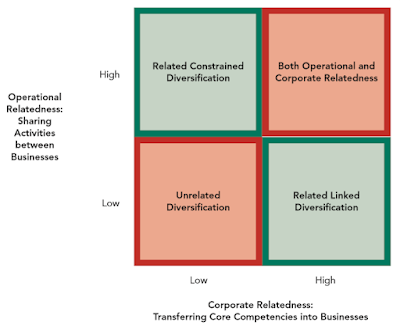

Other dimensions may be emphasis on research and development, raw materials used, quality emphasis, distribution networks, company size. Product life cycle, management skills, financial targets and accounting systems used. The extent of diversity is ascertained by two elements. The first is the extent of difference in one dimension like products produced. The second degree is the number of dimensions in variation. These are the products produced, the type of customers, technology adopted, delivery mechanisms and risks. International diversification entails diversifying an investment portfolio across diverse geographic regions in order to lessen the overall peril and enhance returns on the portfolio. Corporations embrace international diversification by locating their operations in different countries and regions so as to reduce operational and business peril. There are three types of international diversification that is, related diversification, unrelated diversification and single product strategy

Single product strategy

Single product strategy entails the pursuit of manufacturing a single good or service, and selling it in a distinct geographic marketplace. An organization pursuing this strategy further expands the geographical market while concentrating on manufacturing, sales and marketing of a single product or service. For instance, the WD-40 Company embraces this policy. The main benefit of this stratagem is that all efforts of a company are directed to one product. However, the strategy may suffer an immense deal if the product is not accepted by the market, or replaced by a new one (Susman, 2007, p 345).

Related diversification

Related diversification happens when a firm adds to its current line of production or markets. Related diversification enables a company achieve easier the consumption of its products by producing complementing products or services. Related diversification may be further divided into backward, forward and horizontal integration. Forward integration happens when firms diversify to control the onward process of delivering their goods to the consumer. Backward integration is where producers seek greater control over the source of control of raw materials. Horizontal integration entails when an organization adds to its portfolio of products by acquisition. The main merits for this kind of diversification are that it lowers a firm’s dependence on any one of its business activities, apparently lowering economic risk. A firm can also lower overhead costs by managing various businesses at the same time. Overhead costs of a company pursuing related diversification are relatively lower than those of similar businesses, which are not part of a larger conglomerate. Related diversification enables a company to capitalize its strengths and abilities in more than one business. When corporations execute this successfully, they exploit on synergies, which are corresponding effects that subsist among their dealings. Synergy subsists among a set of businesses when the businesses’ monetary worth together is greater than their economic value separately (Caper & Kotabe, 2003, p 350). McDonald’s uses synergy as it diversifies into other food and restaurant businesses.

Unrelated diversification

Unrelated diversification is a company level tactic founded on a multi-business model with the aim of increasing profitability through the use of common organizational capabilities to augment the performance of all the company’s business units. Firms that pursue this mode of diversification strategy are referred to as conglomerates, implying business organizations that function in numerous diverse industries. Conglomerates have no intention of transferring or leveraging capabilities between business units or sharing resources. The sole objective of strategic managers is to embrace their corporation’s general organizational capabilities to strengthen the business models of every individual business units and divisions. If the conglomerates’ strategic managers have the unique skills required to manage numerous companies in diverse industries, the diversification tactic may result in superior performance and profitability. However, managers may not possess the relevant skills for managing companies in different industries.

Advantages of international diversification

Diversification and profit stability

The assertions associating diversification on profit stability revolve around the portfolio concept, which holds that investing in diversified stock with non related profits may lower the precariousness of a corporation’s total gains. The idea of portfolio relates to product diversification, which may lower the variance of a company’s total profits. The reason is that the unpredictability of various profit schemes merged is nearly always less than the unpredictability of every profit stream independently, on condition that the profit streams are negatively related. Researches establish that product diversifiers actually enjoy higher profits than non diversifiers. The degree of risk reduction through unrelated diversification may exceed that which may be attained through related diversification. The reason is that unrelated diversification could lower industry specific systematic risk because it entails diversification across numerous industries. On the other hand, related diversification may not lower industry specific systematic risk happening within an industry. Industry specific systematic risks are the risks universal to all businesses in a certain industry (Kim, Hwang & Burgers, 1989, p 45).

International diversification results in profitability.

Recent research on global diversification has established a positive correlation involving profitability and international market operations intensity. In his study, Rugman asserts that greater levels of profitability for multinational corporations are attributable to intercontinental market imperfection premise, which was advanced by industrial organization economists. The economic scholars explained global marketplaces as a monopolistic or oligopolistic reaction to market limitations. This perspective was further supported by Dubin’s recent study. Dubin established that the need to benefit from proprietary parent skills, which are extremely developed but underutilized, is one of the elements of systematic significance of global acquisitions (Kim, Hwang & Burgers, 1989, p 46).

A similar view was provided by caves on the positive correlation between global marketplace operations and profitability. Caves held that for the presence of a powerful resemblance linking global operations and product differentiation, which is in turn positively correlated to barriers of entry, industry concentration and therefore, profitability. Caves further noted that global market diversification has the impact of stabilizing entire returns. The reason is that fundamental monetary conditions and key political climates are likely to be unrelated across different global marketplaces. Rugman observed the same view, that geographical diversification through direct overseas investments evens out a firm’s profits. This results from existence of divergences in goods and factor markets across geographic areas, evening out an organization entire returns. The theory of international product life cycle ascertains that variances in goods markets arise from divergences in actions of trade unions in labor markets, variances in rates of return on foreign capital, as well as difference in prices of factors of production (Tongli, Ping & Chiu, 2005, p 82).

Spreading risks

Companies operating internationally need to control and balance the overall risks to which they are exposed by constantly reconfiguring their portfolio of overseas auxiliaries in reaction to environmental changes. Conventional studies established that one subsidiary is invested for every two overseas auxiliaries added to a multinational network. Recent studies have established a positive correlation between foreign investment and divestment. In terms of dynamic asset distribution, maintaining a troubled subsidiary operating in a country experiencing massive economic difficulties creates more troublesome risk than eliminating the auxiliary. For instance, multinationals of Japanese origin faced rapidly reduced demand in countries stricken by the economic crisis of Asia in 1990s. The region was taken to be a dead economy, following the devastating economic effects. Given these circumstances, corporations that had undertaken geographical diversification to reduce risk would have quit their auxiliaries in the troubled region, since there was no benefit of retaining them. The goodwill attached to real assets in the troubled countries was negative or close to zero. Therefore, it would have been rational to divest the assets. This phenomenon of Japanese multinational best explains that when a corporation is highly geographically diversified, it enjoys more diversification merits from other non troubled auxiliaries than its operations in predicament stricken nations (Tongli, Ping & Chiu, 2005, p 67). Thus, a company has some incentives to keep subsidiaries in economic struggling nations.

This explanation and reason is in line with divestiture literature that asserts that environmental modifications reduce the gains of diversification, consequently making divestiture one of the most feasible dealings for diversified corporations (Chen, 2008, p 131). The propensity for a regionally diversified firm to separate from a crisis stricken subsidiary operation emerges in some ways from its extent of freedom. In theory, when corporations diversify, the risk of the whole portfolio ought to be less than the weighted total of the risks contributed by every auxiliary (Tallman, 2007, p 23). The risk portion that disappears in the process of constructing the portfolio is known as diversifiable risk, whilst the risk that remains is referred to as non diversifiable risk. As such, the most cost efficient mode for corporations is to configure their worldwide portfolio so that they diversify away diversifiable risks. Additionally, markets in growing economies encounter varying extents of imperfections and larger geo-political instability. Thus, the likelihood of either favorable or adverse changes like taxation structure, wage rates and contractual rules happening in growing economies is bigger (Brigham & Houston, 2009, pg 250).

Growth

Firms diversify their operational globally in order to take advantage of growth opportunities in foreign countries. Avon is a perfect example of a firm enjoying growth resulting from international diversification. Most of Avon’s sales (70%) are derived from international markets, outside its headquarters in North America. Avon has more than 63 sales divisions and territories, and the sales in international divisions accelerated in 1990s, with the organization’s entry into Macedonia, Bosnia, Finland, and Kazakhstan. Growth is the key reason why Avon has put much emphasis on international diversification. The company forecast a dawdling potential for growth in the United States market since there is nearly no remaining untapped market for its cosmetic products. The reason is that the United States beauty market is highly cutthroat. As such, Avon prefers to put emphasis on less competitive markets, as domestic sales chiefly depends on women population growth in its domestic markets. The corporation asserts that even if there was a sizeable unexploited market in United States, it cannot result in more sales because; about five percent of the global populace lives in United States. Much of the diversification that happened in the 1960s was directed towards corporate growth, where the principal motive was the company management’s rather than shareholders. Managers are likely to pursue growth at the expense of profitability, if the corporate size is correlated to their financial gain, power and status. What results is that companies will expand at a faster rate than is congruent with profit maximization, making valuation rations diminish to just short of the point where corporations become susceptible to acquisition. The likeliness of growth goals to propel diversification is probably to be particularly strong for corporations operating in slow growth industries. Diversification by tobacco companies especially in the 1980s was propelled by diminishing sales in domestic markets (Pettigrew, Thomas& Whittington, 2001, pg 89).

Disadvantages of international diversification

Numerous firms like Samsung, Cisco, and UTC have attained the merits of diversification. Nonetheless, diversification may result in several demerits including the following.

Change in the industry or company

Diversification is an intricate growth strategy. The top level managers have to have the ability to identify beneficial opportunities to enter new countries and to implement the strategies required to make diversification profitable. Over time, a company’s executive management usually changes; where able executives leave the organization, retire and/ or step down. When such able managers leave the organization, they leave take their visions with them. A company’s new leader may lack the requisite competence to needed to pursue diversification successfully over time. Therefore, the cost structure eradicates the gains that diversification may have produced. Additionally, the environment usually changes swiftly and impulsively over time. When new technology distorts country boundaries, it may destroy the source of a company’s competitive merit (Costanzo & MacKay, 2009, p 514).

For instance, Apple’s iPhone had become a direct rival to Nintendo in 2009 for playing games on small cellular phone devices. When such a critical technological change happens in a company’s core capabilities, the gains it had previously made from transferring or leveraging distinctive capabilities disappear. The company is left with a collection of businesses that have all become poor players in their relevant industries, since they are not based on the new technology. Sony experienced this disadvantage. As such, a key problem with diversification is that the future successes of this strategy are tricky to predict (Sinkovics & Ghauri, 2009, p 259).

Diversification for the wrong reasons

Sometimes, managers pursue diversification without a clear vision of how their entry into new countries will enable them to make new products that offer more value to clients and thereby increase their firm’s profitability. Previously, risk pooling was used as a justification for diversification, since the strategy would make entities benefit from risk pooling. The key idea behind risk pooling is that a firm may lower the risk of its revenues and profits from growing and falling penetratingly, as this may lower the firm’s stock price if it operates in countries with varying business cycles. Business cycle refers to the likelihood for incomes and profits of corporations in an industry to increase and decrease over time due to conventional changes in consumer demand. For instance, during recession, the profits earned by supermarkets may be fairly stable as people still need to eat. For instance, Wal-Mart sales may increase as customers strive to get value for their money during recession. At the same, a recession resulted in lowering of demand for cars and other luxury goods.

Many chief executives held that diversifying into industries and countries that have different business cycles, the sales and earnings of some of their divisions would be increasing whereas those in others will be diminishing. The net effect is thus a more unwavering stream of earning and profits over time. For instance, the United States steel diversified into the oil and gas industry as an endeavor to offset the harsh effects of cyclical dips in the steel industry. Nevertheless, this argument underscores on two significant elements (Wiersema & Bowen, 2008, p 120). One, stockholders may eradicate the peril inherent in holding a single stock by diversifying their personal portfolios, which they can do at a lower cost than a corporation. As such, efforts to collect perils together through diversification signify a fruitless use of reserves; rather, profits should be returned to investors in forms of dividends.

Introduction

Diversification is the process of investing assets across a wide range of classes in differing proportions depending on an investor’s goals’, risk tolerance and time horizon. Although diversification does not guarantee the best performance or eradicate risks of investment losses, it helps in alleviating speculation usually involved in investing. Diversification may well be used to refer to the variation between businesses within a company. This variation may be by products and/ or services. Diversification meaning varies across businesses, as what stands as diversification in one organization may not have significance in another. Thus, the definition of diversification is subjective. Nonetheless, business diversification may be in the dimension of cost leadership, production of commodity products, new product development, market leadership, strong brand names, high value added products, niche markets served, customers shared, advertisement emphasis, customer service emphasis and product design.

Other dimensions may be emphasis on research and development, raw materials used, quality emphasis, distribution networks, company size. Product life cycle, management skills, financial targets and accounting systems used. The extent of diversity is ascertained by two elements. The first is the extent of difference in one dimension like products produced. The second degree is the number of dimensions in variation. These are the products produced, the type of customers, technology adopted, delivery mechanisms and risks. International diversification entails diversifying an investment portfolio across diverse geographic regions in order to lessen the overall peril and enhance returns on the portfolio. Corporations embrace international diversification by locating their operations in different countries and regions so as to reduce operational and business peril. There are three types of international diversification that is, related diversification, unrelated diversification and single product strategy

Single product strategy

Single product strategy entails the pursuit of manufacturing a single good or service, and selling it in a distinct geographic marketplace. An organization pursuing this strategy further expands the geographical market while concentrating on manufacturing, sales and marketing of a single product or service. For instance, the WD-40 Company embraces this policy. The main benefit of this stratagem is that all efforts of a company are directed to one product. However, the strategy may suffer an immense deal if the product is not accepted by the market, or replaced by a new one (Susman, 2007, p 345).

Related diversification

Related diversification happens when a firm adds to its current line of production or markets. Related diversification enables a company achieve easier the consumption of its products by producing complementing products or services. Related diversification may be further divided into backward, forward and horizontal integration. Forward integration happens when firms diversify to control the onward process of delivering their goods to the consumer. Backward integration is where producers seek greater control over the source of control of raw materials. Horizontal integration entails when an organization adds to its portfolio of products by acquisition. The main merits for this kind of diversification are that it lowers a firm’s dependence on any one of its business activities, apparently lowering economic risk. A firm can also lower overhead costs by managing various businesses at the same time. Overhead costs of a company pursuing related diversification are relatively lower than those of similar businesses, which are not part of a larger conglomerate. Related diversification enables a company to capitalize its strengths and abilities in more than one business. When corporations execute this successfully, they exploit on synergies, which are corresponding effects that subsist among their dealings. Synergy subsists among a set of businesses when the businesses’ monetary worth together is greater than their economic value separately (Caper & Kotabe, 2003, p 350). McDonald’s uses synergy as it diversifies into other food and restaurant businesses.

Unrelated diversification

Unrelated diversification is a company level tactic founded on a multi-business model with the aim of increasing profitability through the use of common organizational capabilities to augment the performance of all the company’s business units. Firms that pursue this mode of diversification strategy are referred to as conglomerates, implying business organizations that function in numerous diverse industries. Conglomerates have no intention of transferring or leveraging capabilities between business units or sharing resources. The sole objective of strategic managers is to embrace their corporation’s general organizational capabilities to strengthen the business models of every individual business units and divisions. If the conglomerates’ strategic managers have the unique skills required to manage numerous companies in diverse industries, the diversification tactic may result in superior performance and profitability. However, managers may not possess the relevant skills for managing companies in different industries.

Diversification and profit stability

The assertions associating diversification on profit stability revolve around the portfolio concept, which holds that investing in diversified stock with non related profits may lower the precariousness of a corporation’s total gains. The idea of portfolio relates to product diversification, which may lower the variance of a company’s total profits. The reason is that the unpredictability of various profit schemes merged is nearly always less than the unpredictability of every profit stream independently, on condition that the profit streams are negatively related. Researches establish that product diversifiers actually enjoy higher profits than non diversifiers. The degree of risk reduction through unrelated diversification may exceed that which may be attained through related diversification. The reason is that unrelated diversification could lower industry specific systematic risk because it entails diversification across numerous industries. On the other hand, related diversification may not lower industry specific systematic risk happening within an industry. Industry specific systematic risks are the risks universal to all businesses in a certain industry (Kim, Hwang & Burgers, 1989, p 45).

International diversification results in profitability.

Recent research on global diversification has established a positive correlation involving profitability and international market operations intensity. In his study, Rugman asserts that greater levels of profitability for multinational corporations are attributable to intercontinental market imperfection premise, which was advanced by industrial organization economists. The economic scholars explained global marketplaces as a monopolistic or oligopolistic reaction to market limitations. This perspective was further supported by Dubin’s recent study. Dubin established that the need to benefit from proprietary parent skills, which are extremely developed but underutilized, is one of the elements of systematic significance of global acquisitions (Kim, Hwang & Burgers, 1989, p 46).

A similar view was provided by caves on the positive correlation between global marketplace operations and profitability. Caves held that for the presence of a powerful resemblance linking global operations and product differentiation, which is in turn positively correlated to barriers of entry, industry concentration and therefore, profitability. Caves further noted that global market diversification has the impact of stabilizing entire returns. The reason is that fundamental monetary conditions and key political climates are likely to be unrelated across different global marketplaces. Rugman observed the same view, that geographical diversification through direct overseas investments evens out a firm’s profits. This results from existence of divergences in goods and factor markets across geographic areas, evening out an organization entire returns. The theory of international product life cycle ascertains that variances in goods markets arise from divergences in actions of trade unions in labor markets, variances in rates of return on foreign capital, as well as difference in prices of factors of production (Tongli, Ping & Chiu, 2005, p 82).

Spreading risks

Companies operating internationally need to control and balance the overall risks to which they are exposed by constantly reconfiguring their portfolio of overseas auxiliaries in reaction to environmental changes. Conventional studies established that one subsidiary is invested for every two overseas auxiliaries added to a multinational network. Recent studies have established a positive correlation between foreign investment and divestment. In terms of dynamic asset distribution, maintaining a troubled subsidiary operating in a country experiencing massive economic difficulties creates more troublesome risk than eliminating the auxiliary. For instance, multinationals of Japanese origin faced rapidly reduced demand in countries stricken by the economic crisis of Asia in 1990s. The region was taken to be a dead economy, following the devastating economic effects. Given these circumstances, corporations that had undertaken geographical diversification to reduce risk would have quit their auxiliaries in the troubled region, since there was no benefit of retaining them. The goodwill attached to real assets in the troubled countries was negative or close to zero. Therefore, it would have been rational to divest the assets. This phenomenon of Japanese multinational best explains that when a corporation is highly geographically diversified, it enjoys more diversification merits from other non troubled auxiliaries than its operations in predicament stricken nations (Tongli, Ping & Chiu, 2005, p 67). Thus, a company has some incentives to keep subsidiaries in economic struggling nations.

This explanation and reason is in line with divestiture literature that asserts that environmental modifications reduce the gains of diversification, consequently making divestiture one of the most feasible dealings for diversified corporations (Chen, 2008, p 131). The propensity for a regionally diversified firm to separate from a crisis stricken subsidiary operation emerges in some ways from its extent of freedom. In theory, when corporations diversify, the risk of the whole portfolio ought to be less than the weighted total of the risks contributed by every auxiliary (Tallman, 2007, p 23). The risk portion that disappears in the process of constructing the portfolio is known as diversifiable risk, whilst the risk that remains is referred to as non diversifiable risk. As such, the most cost efficient mode for corporations is to configure their worldwide portfolio so that they diversify away diversifiable risks. Additionally, markets in growing economies encounter varying extents of imperfections and larger geo-political instability. Thus, the likelihood of either favorable or adverse changes like taxation structure, wage rates and contractual rules happening in growing economies is bigger (Brigham & Houston, 2009, pg 250).

Growth

Firms diversify their operational globally in order to take advantage of growth opportunities in foreign countries. Avon is a perfect example of a firm enjoying growth resulting from international diversification. Most of Avon’s sales (70%) are derived from international markets, outside its headquarters in North America. Avon has more than 63 sales divisions and territories, and the sales in international divisions accelerated in 1990s, with the organization’s entry into Macedonia, Bosnia, Finland, and Kazakhstan. Growth is the key reason why Avon has put much emphasis on international diversification. The company forecast a dawdling potential for growth in the United States market since there is nearly no remaining untapped market for its cosmetic products. The reason is that the United States beauty market is highly cutthroat. As such, Avon prefers to put emphasis on less competitive markets, as domestic sales chiefly depends on women population growth in its domestic markets. The corporation asserts that even if there was a sizeable unexploited market in United States, it cannot result in more sales because; about five percent of the global populace lives in United States. Much of the diversification that happened in the 1960s was directed towards corporate growth, where the principal motive was the company management’s rather than shareholders. Managers are likely to pursue growth at the expense of profitability, if the corporate size is correlated to their financial gain, power and status. What results is that companies will expand at a faster rate than is congruent with profit maximization, making valuation rations diminish to just short of the point where corporations become susceptible to acquisition. The likeliness of growth goals to propel diversification is probably to be particularly strong for corporations operating in slow growth industries. Diversification by tobacco companies especially in the 1980s was propelled by diminishing sales in domestic markets (Pettigrew, Thomas& Whittington, 2001, pg 89).

Disadvantages of international diversification

Numerous firms like Samsung, Cisco, and UTC have attained the merits of diversification. Nonetheless, diversification may result in several demerits including the following.

Change in the industry or company

Diversification is an intricate growth strategy. The top level managers have to have the ability to identify beneficial opportunities to enter new countries and to implement the strategies required to make diversification profitable. Over time, a company’s executive management usually changes; where able executives leave the organization, retire and/ or step down. When such able managers leave the organization, they leave take their visions with them. A company’s new leader may lack the requisite competence to needed to pursue diversification successfully over time. Therefore, the cost structure eradicates the gains that diversification may have produced. Additionally, the environment usually changes swiftly and impulsively over time. When new technology distorts country boundaries, it may destroy the source of a company’s competitive merit (Costanzo & MacKay, 2009, p 514).

For instance, Apple’s iPhone had become a direct rival to Nintendo in 2009 for playing games on small cellular phone devices. When such a critical technological change happens in a company’s core capabilities, the gains it had previously made from transferring or leveraging distinctive capabilities disappear. The company is left with a collection of businesses that have all become poor players in their relevant industries, since they are not based on the new technology. Sony experienced this disadvantage. As such, a key problem with diversification is that the future successes of this strategy are tricky to predict (Sinkovics & Ghauri, 2009, p 259).

Diversification for the wrong reasons

Sometimes, managers pursue diversification without a clear vision of how their entry into new countries will enable them to make new products that offer more value to clients and thereby increase their firm’s profitability. Previously, risk pooling was used as a justification for diversification, since the strategy would make entities benefit from risk pooling. The key idea behind risk pooling is that a firm may lower the risk of its revenues and profits from growing and falling penetratingly, as this may lower the firm’s stock price if it operates in countries with varying business cycles. Business cycle refers to the likelihood for incomes and profits of corporations in an industry to increase and decrease over time due to conventional changes in consumer demand. For instance, during recession, the profits earned by supermarkets may be fairly stable as people still need to eat. For instance, Wal-Mart sales may increase as customers strive to get value for their money during recession. At the same, a recession resulted in lowering of demand for cars and other luxury goods.

Many chief executives held that diversifying into industries and countries that have different business cycles, the sales and earnings of some of their divisions would be increasing whereas those in others will be diminishing. The net effect is thus a more unwavering stream of earning and profits over time. For instance, the United States steel diversified into the oil and gas industry as an endeavor to offset the harsh effects of cyclical dips in the steel industry. Nevertheless, this argument underscores on two significant elements (Wiersema & Bowen, 2008, p 120). One, stockholders may eradicate the peril inherent in holding a single stock by diversifying their personal portfolios, which they can do at a lower cost than a corporation. As such, efforts to collect perils together through diversification signify a fruitless use of reserves; rather, profits should be returned to investors in forms of dividends.

Secondly, corporate diversification may not be an efficient way to collect perils since the business cycles of different countries and industries are intrinsically complex to forecast. Apparently, it is probable that a diversified corporation will find that an economic slump affects all its industries in one country instantaneously. When such a situation arises, the firm’s profitability falls. When a company’s key business in one country is in trouble, another mistaken gratification for diversification is that entry into new countries will liberate it and result in enduring growth and profitability. For instance, Kodak made such a mistake. In 1980, Kodak sales and profits rose to the plateau and then fell following intense competition from Fuji; low cost Japanese rivals. In addition, the emergence of digital revolution heavily affected the company’s revenues. Its managers went ahead and spend billions of dollars entering new markets and industries like biotechnology and computer hardware, as desperate efforts to augment profitability. This resulted in massive cost increases and a disastrous venture because Kodak invested in companies with a heavy global presence like canon, Xerox and 3M.

Complexity in implementation of international diversification strategy

There are several aspects that are essential for implementing international diversification. A firm going international must have the capacities to execute activities such as product adaptation and advertising. Nonetheless, there exist impending complicating factors that limit a firm’s ability to carry out these activities successfully. Porter held that greater geographical dispersion increases management, coordination and distribution costs (Toyne, nigh, 509). To obtain the merits of economies of scale necessitates coordination and the capability to distribute foods and services efficiently on a worldwide basis. Other barriers that may hamper coordination and efficient distribution is the existence of diverse government regulations, trade laws and cultural differences across countries. These barriers may make it complex to shift competitive merit across borders. Implementation difficulties and barriers are made worse when an organization has a diversified product line. The reason is that rules and regulations sometimes vary depending on the product line. Moreover, coordination has to be attained across geographical boundaries and product divisions (Griffin, 2012, p 229).

Increase in transaction costs

International diversification results in increase in transaction costs for management. Geographical dispersion exceedingly increases managerial information processing demands and transaction costs. Geographical spreading further increases distribution, management and coordination costs. Additionally, a firm needs to have the capacity to integrate coordination, management and distribution knowledge efficiently, when it is involved in diverse markets in a continuing business as an engagement in a diversity markets may obstruct the speed of an organization’s learning (Toyne & Nigh, 1997, p 511).

Conclusion

In conclusion, several advantages accrue from firms engaging in international diversification. These include the stability of profitability, spreading of risks and significant growth. However, international diversification face numerous challenges, as they must set up global integration of their international operations, whilst allowing local operations the autonomy needed to retort to idiosyncratic markets. Therefore, globally diversified organizations have to be concurrently centralized and decentralized (Chandra, 2008, p 698). They must centralize to attain global integration, and decentralize to permit local market autonomy. The mode of attaining simultaneous centralization and decentralization are quite intricate, and calls for a sound management. The sound management may be rare to find. However, the merits and gains of international diversification outweigh the demerits, especially after an organization has reached its optimum to enjoy economies of scale. As such, it is beneficial for firms to pursue diversification, particularly related diversification.

Complexity in implementation of international diversification strategy

There are several aspects that are essential for implementing international diversification. A firm going international must have the capacities to execute activities such as product adaptation and advertising. Nonetheless, there exist impending complicating factors that limit a firm’s ability to carry out these activities successfully. Porter held that greater geographical dispersion increases management, coordination and distribution costs (Toyne, nigh, 509). To obtain the merits of economies of scale necessitates coordination and the capability to distribute foods and services efficiently on a worldwide basis. Other barriers that may hamper coordination and efficient distribution is the existence of diverse government regulations, trade laws and cultural differences across countries. These barriers may make it complex to shift competitive merit across borders. Implementation difficulties and barriers are made worse when an organization has a diversified product line. The reason is that rules and regulations sometimes vary depending on the product line. Moreover, coordination has to be attained across geographical boundaries and product divisions (Griffin, 2012, p 229).

Increase in transaction costs

International diversification results in increase in transaction costs for management. Geographical dispersion exceedingly increases managerial information processing demands and transaction costs. Geographical spreading further increases distribution, management and coordination costs. Additionally, a firm needs to have the capacity to integrate coordination, management and distribution knowledge efficiently, when it is involved in diverse markets in a continuing business as an engagement in a diversity markets may obstruct the speed of an organization’s learning (Toyne & Nigh, 1997, p 511).

Conclusion

In conclusion, several advantages accrue from firms engaging in international diversification. These include the stability of profitability, spreading of risks and significant growth. However, international diversification face numerous challenges, as they must set up global integration of their international operations, whilst allowing local operations the autonomy needed to retort to idiosyncratic markets. Therefore, globally diversified organizations have to be concurrently centralized and decentralized (Chandra, 2008, p 698). They must centralize to attain global integration, and decentralize to permit local market autonomy. The mode of attaining simultaneous centralization and decentralization are quite intricate, and calls for a sound management. The sound management may be rare to find. However, the merits and gains of international diversification outweigh the demerits, especially after an organization has reached its optimum to enjoy economies of scale. As such, it is beneficial for firms to pursue diversification, particularly related diversification.