On every registered KRA PIN there is a tax obligation. But, many people do not understand what this tax obligation mean. Do you know the tax obligation on your KRA PIN?

Tax obligation defines the type of tax an individual or a company is supposed to pay and it differs from one KRA PIN to another. This difference is majorly due to differences in income source. There are people who pay tax from employment, others business, others rental income and so forth. An individual or company KRA PIN is supposed to have a tax obligation that reflects where an individual or company income comes from.

But, many people register KRA PIN without thinking of tax obligation. As a result they apply KRA PIN with a wrong obligation. Also, the people, majorly cyber attendants, who help individuals apply for a KRA PIN at times make mistakes and register individuals on wrong tax obligations. I have met many people with VAT tax obligation and yet they do not have any business.

Here are a few tax obligations and some information about them:

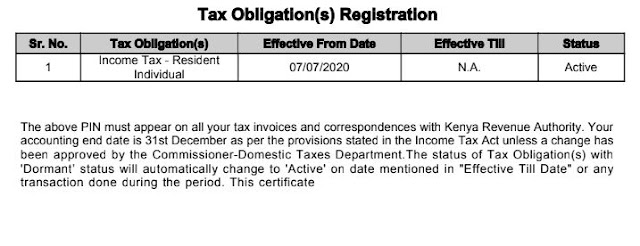

- Income Tax -Resident Individual. This is the obligation that employed and unemployed individuals are supposed to have in their KRA PINs. For people in employment this is what is called Pay As You Earn. It is deducted every month. For people in business they are supposed to prepare books of account and pay the tax once per year.

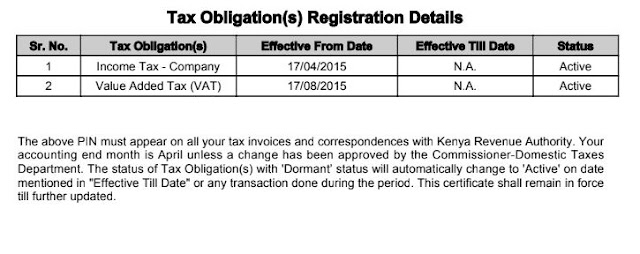

- Value Added Tax. This is a tax obligation for people in business who deal with taxable goods and services. Every business that make sales of above 5 million is supposed to have this obligation. Also, businesses that make good sales but below 5 million are encouraged to register for this tax obligation. This is one of the tax obligations that make people in business to find themselves on the wrong side of the law. This obligation requires one to have an ETR machine.

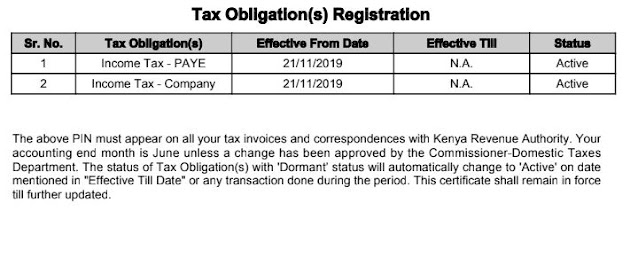

- Income Tax - Company. These tax obligation is for people with companies. This type of return is filed once per year depending on when the company year ends. This means if the year ends on June it will be filed on July and if the year ends on December then it is filed on January. This is the obligation that makes business to prepare audited books of accounts. Failure to file this return attracts ksh10,000/= penalty per year.

- Income Tax - PAYE. This tax obligation is for people with employees who earn taxable pay. Employers are supposed to deduct employees P.A.Y.E and submit it to KRA by 9th of the following month. Failure to file this return attracts a penalty of ksh10,000/= per month. Note, this tax obligation can be added on an individual KRA PIN if the person has employees with taxable salary.

- Monthly Rental Income (MRI). This is tax obligation for individuals who are landlords, that is, every person or company that earn rental income. Rental income is taxed at 10% and it is supposed to be filed by date 20th of the following month.